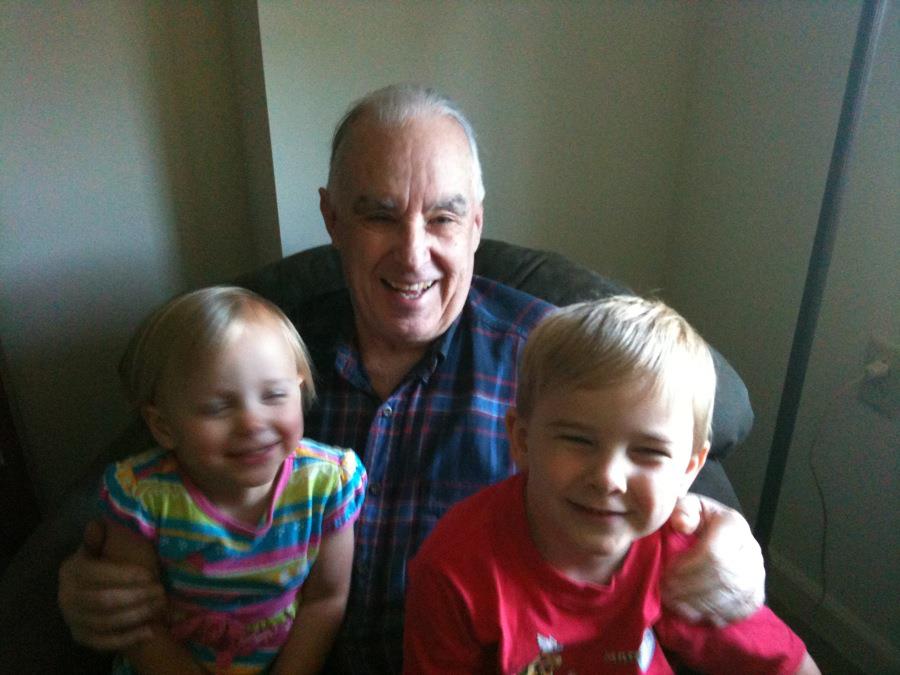

Dad’s happy where he’s living, even if it isn’t the plan he originally had for his retirement.

My parents worked really, really hard their entire working lives, as most do. They worked so hard so that they could play and have fun and travel the Caribbean 10 times over when they retired. Unfortunately, my mom was ill and my dad was her caregiver, and after my mom passed, my dad’s health has declined. Their careful, cautious planning financially meant that we kids had few if any student loans for college, and they had/my dad has a very steady income as well as earnings from smart investments.

As my father’s health has declined, it’s gotten more and more clear to my husband and I just how careful we must be to PLAN for the future. As his Primary Progressive Aphasia and now Alzheimer’s have progressed, it’s meant that he’s needed more and more services where he is living. Thanks to their careful planning and saving, the cost of things is not an issue, and we aren’t forced to make difficult choices that I’ve watched too many people have to make. I am sure that at some point, my parents knew that in part, planning for retirement was not going to be all about traveling and having fun, although it isn’t something anyone would want to think about.

In this day and age of technology and the internet, being able to access your money and investments online, and even do some trading online is here, and I would wager a guess that it’s here to stay. We may not take a lot of risks right now with money, but when we do, we’ll look to sites like CedarFinance.com, an innovative consumer trading company offering clients an easy and intuitive way to trade on the leading financial markets – Forex, Commodities, Indices or Stock, or others to find ways to help us earn some profits so that we can set money aside for the “way later” part of life that may come far too soon, as my dad’s did.

Digital Options are a new and popular financial tool with many inherent advantages, and Cedar Finance’s unique offering enables traders to receive significant and predetermined payouts (68%-81%), and to minimize loss when being off-target (by retaining 5%-10% of the original investment, predetermined per case). Digital options from Cedar Finance are straightforward to understand and rewarding to trade.

Bekah Kuczenski says

I am really bad at saving and planning for the future. But, I need to start now so that one day my hubby and I can enjoy retirement 😉

Michelle F. says

Thanks for sharing. I will definately be looking into this for my daughter.