As I sit here looking at the far too big folder of all of our tax papers… and really just would like to avoid the task one more day, it got me to thinking about budgets and taxes and ways to stay on top of things. My friends at Windows sent over these tips for tax time and helpful budget tips and I thought I’d share with you all. I mean, we all have to pay taxes, right? Whether we like it or not?

Are finances on top of your mind this month? With taxes due April 15th, there’s no better time to catch the budget bug!

Whether you’re interested in maximizing your refund or streamlining your finances for the year ahead, apps from Windows and Windows Phone have your back. We love our Windows devices in this house (some of which were sent as part of the Windows Champions program but most of which we bought on our own.

1. Check Your Status

Everyone has the same question as they’re filing their taxes – what’s my refund going to be?! Apps on Windows and Windows Phone remove the guesswork. TryTaxCaster on Windows Phone, utilizing the same calculator found in TurboTax, to quickly enter some basic information and watch your refund amount add up. Once you’ve filed, MyTaxRefund on Windows will allow you to quickly check the status of your return and give you an immediate estimate of when you can expect your refund.

2. Make the Most of Your Refund

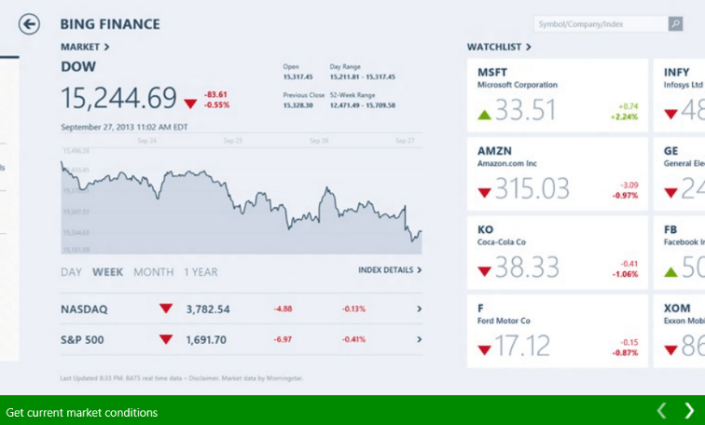

Sure, you’ve probably already made plans for how you want to spend some of your refund once you get it. What about the rest? Invest and maximize your refund with Bing Finance on Windows Phone and Windows, which helps you stay on top of fast-changing market conditions so you can make the most informed financial decisions. Keep an eye on all of your investments with SigFig, and sync all of your accounts in one place to track all of your stocks, funds, 401ks and IRAs in real time, available on Windows and Windows Phone.

3. Budget Tips

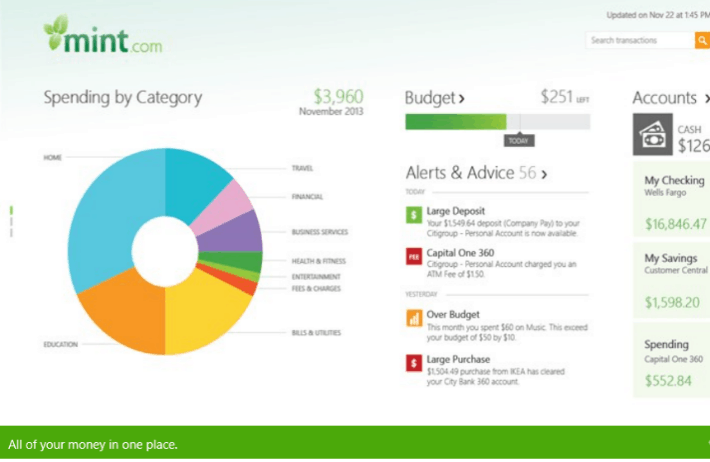

Get in the mood to save more money for next tax season. On both Windows andWindows Phone, Mint helps you understand where you’re spending your money with helpful charts and graphs that make saving easy. Use Billminder on yourWindows Phone or laptop to keep an eye on all of your monthly bills so you never miss a payment (and know how much you have left to spend!). Save for the next step of your life with MoBu Financial Management on Windows Phone andWindows. MoBu allows you to view your current financial assets as well as the opportunity to simulate your future savings with how much you can save in 5, 10, or 20 years!

Make it Easy with Microsoft’s New Wireless Mobile Mouse 1850

You’ll find Microsoft’s new Mobile Mouse 1850 very helpful when trying to do your taxes, or stay on top of your finances from the road. Make your life easier and spend a little of your tax refund on this value mouse, that retails for only $14.95.

Designed for comfort and portability, the Wireless Mobile Mouse 1850 is great for life on the go, offering wireless freedom and built-in transceiver storage for ultimate mobility.

Comfortable to use with either hand and with a scroll wheel for easy navigation, this mouse is the ideal device for your modern, mobile lifestyle. I really would like the pink one. I love pink. In case anyone’s asking…

If you are doing the weekly savings challenge, and you’ve maybe fallen behind or want to do a boost, consider throwing some of your tax refund towards it.

Have you filed your taxes? Do you have any helpful budget tips?

No compensation received for this post. As part of my Windows Champions Ambassadorship, I have received devices to use to familiarize myself with Windows and Microsoft. Opinions are my own.

Greta says

There really is an app for everything, isn’t there?

Danielle says

We just filed our taxes last week… I am so glad we use a reputable accounting firm, as a friend of mine who does not just found out she is being audited. Her mom has been in a coma the entire past year, and with all of the moving around, she has no idea where her paperwork from the last five years is located. Such a stressful situation 🙁

Janeane Davis says

It is important to have a plan for tax refunds and other money as well so that we are satisfied with the results of our spending plans.

Michele Brosius says

Thanks for sharing some great tips! I didn’t know there were tax refund related apps. As soon as I get my taxes in order (uugghh) I will be searching for those apps.

Melanie S. says

I am so very behind this year. I haven’t even looked at tax stuff yet. Next weekend. I promise. 🙂

AImee Smith says

Ugh taxes are not my favorite, but we do love Mint.com. Thanks for the tips!

Katy Rawson says

These are great tips. I have already files my taxes this year, but I’ll have to remember a few of these for next year.

Robin {Mom Foodie} says

I haven’t done mine yet, but better start very soon… they are a nightmare.

Jenn @ The Rebel Chick says

Noone enjoys tax time right. But it is so helpful to have everything organized and ready.

Angela S says

I hope to finish mine up this weekend. Tax time is rough. Thanks for the resources.

Sarah L says

Taxes done.

Budget tip: shop at thrift stores.

Debbie Denny says

Very good advice. Thanks

Annie {Stowed Stuff} says

Great tips! We used to use mint, but our new bank’s login system doesn’t work with it anymore (super secure double logins). Nothing better than taking charge of your finances!

Rachael says

These are some great tips. I haven’t done my taxes yet. Probably next weekend.

annie says

Great tips! I love Mint.com – it is an excellent way to track your money 🙂

Karen says

My husband owns his own business so we have an accountant do our taxes. I wish I had some helpful tips but I am awful with money!

Liz Mays says

My tax appointment is tomorrow. I’m not really looking forward to it. Inevitably, she’ll need some kind of information I have to dig for at home. I won’t get a refund, but I would save it if I did. 🙂

Krystyn @ Really, Are You Serious? says

Yes. We’ve filed. And it was super sad! I did a terrible job of keeping business expense receipts. I’m trying to do much better this year!

Debra says

Great tips. We’re just finishing up collecting all our materials and taking them to get our taxes done today in fact. I hope we did alright!

Stacey @ Cheap is the New Classy says

When we get our tax refund (or a bonus at work), we put 65% toward the mortgage, 25% towards another loan we have, and 10% in savings. This seems to work well for us!