2020 has been quite a year. It started out sort of normal and then COVID-19 arrived in a whirlwind and turned life as we know it upside down and inside out. Most, if not all of us, have experienced some new challenges and obstacles we’ve never faced before, and I think it’s reminded all of us that we need to work on having savings because YOU JUST NEVER KNOW what may happen. In light of that, I’m sharing some money tips for families- some you’ve maybe seen me share before, but they are good to remember and it’s nice to have reminders- and visuals. This post is in collaboration with our friends at Pigly. Opinions and ideas are my own.

Money Saving Tips for Families

Pigly.com offers a wide range of tools from savings, budgeting, retirement planning, mortgages, auto loans, personal loans, and so on, and their site offers a little something for everyone. There’s a good deal of content to select from within the different areas- you can select basic amounts or delve into things with more specific parameters. I stick to basics.

Spending:

Start spending less. If you can. I say that half jokingly, but I’m aware that some folks are spending as little as possible and that’s not a joke. So IF you can spend less, do it. Even if it’s just spending less on one thing a month. Do you really NEED to be able to watch Netflix on 5 devices at once? That’s a super simple way to save a few dollars a month. Saving now can help you save for a financial goal- a big vacation, secondary education, a new home, etc. You could even use a refinance mortgage calculator to see if it’s a good idea for you to refinance your mortgage and free up some extra cash that way. It’s not for everyone, but it could work.

Savings:

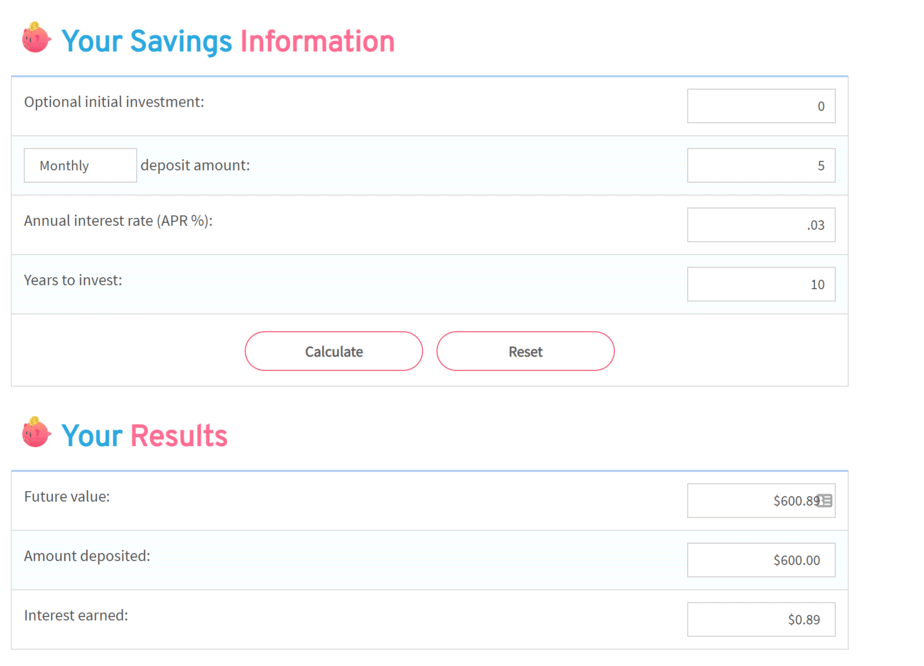

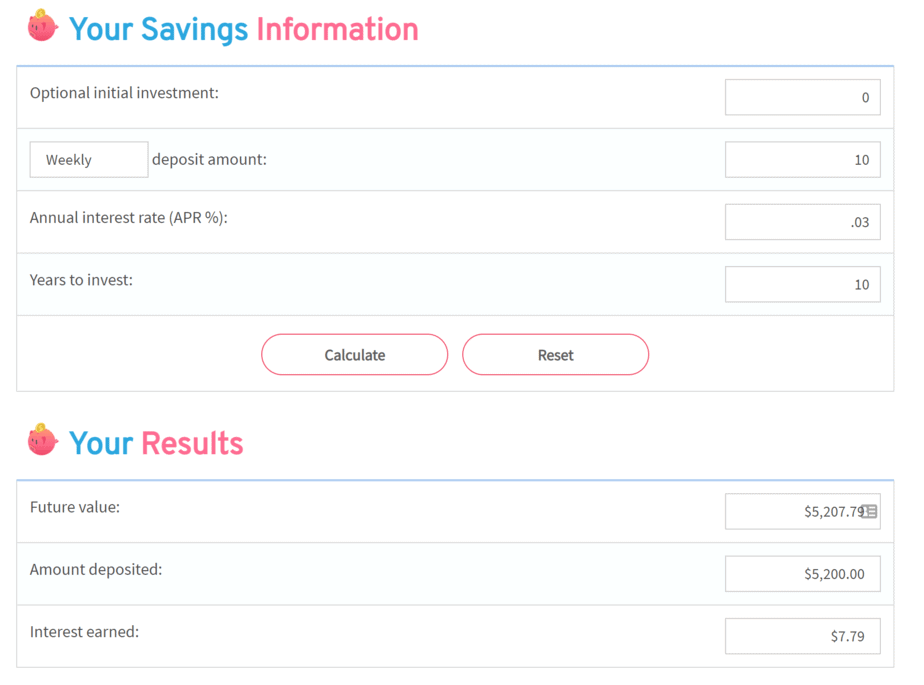

Start saving money now, even if it is only $5 a month. I’m literally using the bare bones I can think of to illustrate why this is important, hence the .03% APR. So over time, your $5 a month turns into several hundred dollars. I know, I know, it’s not that exciting.

That money will add up over time and when you have any emergency, you will thank yourself! If you can set up an automatic deduction, it makes it less painful to save that money!!

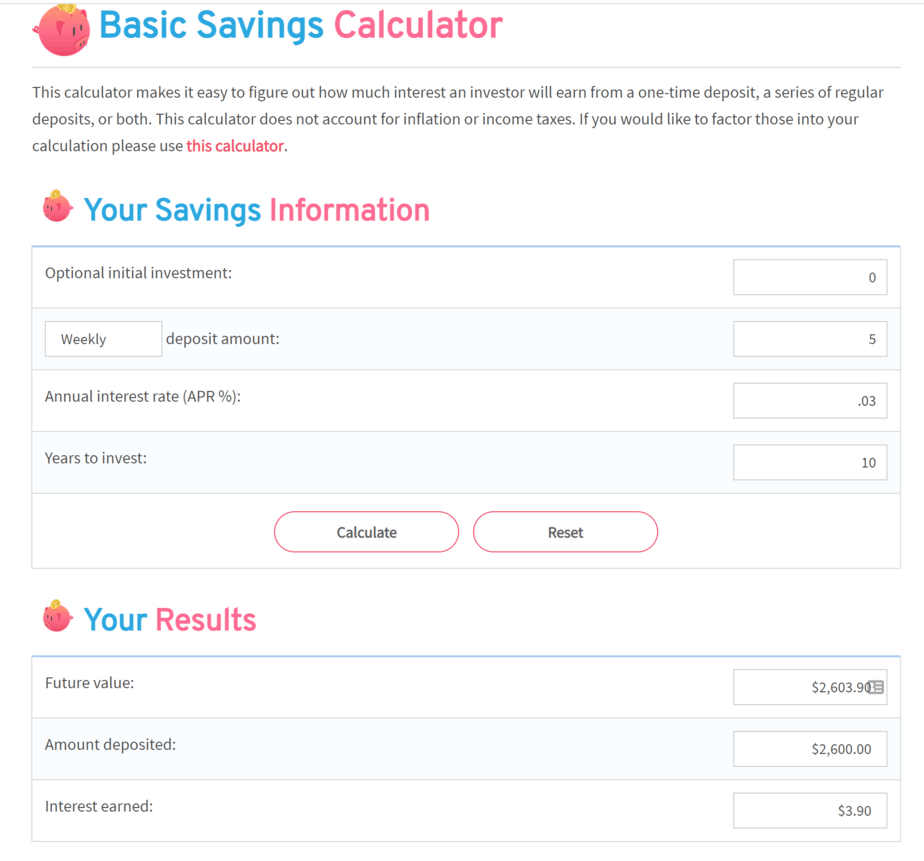

Now, let’s just see if we swap that once a month $5 and do it weekly. Look at the difference in savings!

Use a savings calculator like this basic savings calculator from Pigly that can show you where that $5 can lead you to over time!

Income Boost:

When you’re looking for ways to save money, it would be remiss to ignore any ways you might be able to boost what you have coming in. You might not be in a position to go back to work, change jobs or get a raise, but there are still plenty of ways you could boost your income. Whether you need a quick way to make $500 for a one-off expense or you’re looking for a long-term way to get some more cash coming in, you can find lots of ways to make extra money that are suitable for families.

If you’re a stay-at-home parent, you ideally want things that you can do in those few spare moments of downtime. This could include filling out surveys or completing freelance assignments at home. You might be able to make money by renting out things you’re not using or selling stuff you no longer need. Another option is also to find things you can do with your kids. For example, delivering food with one of the delivery apps could actually be a fun thing to do with one or two older children. You get to spend time together and you could even use the time to teach them about math and other things at the same time.

Utilities:

Not using it? Unplug it. The toaster, the coffee maker, the hair dryer, the paper shredder… all of those things plugged in are pulling in electricity which means you’re paying for them. Adjust the thermostat. Even by one degree. Not to torture the people in your house, although my teenagers would tell you otherwise, but because one degree likley won’t be felt by humans, but can quickly add up when your heating bill comes up. This is where the fun fuzzy blankets and socks and sweatshirts come in extra handy.

If your utility companies offer an energy audit, take advantage of it. See where you can make small adjustments. We’re slowly changing all of the lightbulbs in our house to LED daylight bulbs- so as old ones burn out or we notice sales/coupons on the bulbs we want, we are gradually switching things over. Going for a drive? Charge your phone and other devices while you’re already in the car!

If you’re replacing shower heads or faucets, look for low flow. Toilets even come with different flush options now, so you’re conserving water usage. This is always good for the environment, but also good for your bills if you live in an area where you pay for water usage.

Menu Planning:

Menu planning is a hot trend right now. Plan it, shop by the list, you can even find menu plans from bloggers all over the place. Having a plan and shopping to the plan has helped us from ‘forgetting’ about the xyz produce in the veggie drawer or the meat we didn’t use in time…so we’re wasting less food. If I shop and there’s a great deal on a specific ingredient, we adjust the menu plan when home to accomodate that change. I’ve also started enlisting the people who live in my house to help with the menu planning, because if ALL of us are home, why am I the one having to come up with these ideas? This all kicked into gear a few months into covid shutdowns and it’s worked well. There have been nights when we have a lot of leftover food or someone wasn’t hungry…and then we modify the plan to accomodate for SOAP nights (Stuff On A Plate) so as not to waste leftovers. Small amounts of leftovers are excellent for lunches the next day. Overall, the menu planning has been great for the family-it’s also kept us in a better routine of not being in a rut and going to the same recipes and meals week after week. My youngest and I have started to laminate menu plans so we can reuse them without risk of spills.

Plan for lunches when you menu plan. Sandwiches are an easy thing to bring along for lunch, but if you or your spouse need to take a lunch with you to work, keeping a variety will help you to stick to bringing lunches and offer less temptation to just grab something more appealing from a restaurant….which keeps spending down and hopefully savings increasing.

I know I showed you the savings calculator before, but let me just add to it in this section as well. Even if you just spend $5 each week LESS on eating out/grabbing lunch while at work (including a coffee at a drive thru), LOOK at what that can add up to over time! For this I assumed you’re doing the $5 a week plus an extra $5 from NOT buying a single lunch/a coffee each week.

Keep eating out for special occasions like a birthday, anniversary, graduation, etc. I know right now many of us aren’t even going out to eat, but eventually we will again. We do order pizza every few weeks, usually on Friday nights, but we make a salad here at home to go with it for all of us to eat. We’re still paying for takeout/delivery, but we’re minimizing our expense of it by doing our own sides and drinks.

Household Expenses:

Cut back on anything you can to save money. Right now, we’re all home more often than not thanks to COVID-19. The surprise benefit of this is that our vehicle expenses are lower- less frequent oil changes, less gas consumption, less temptation to just grab xyz since we’re out. I think my car has gone 5000+ miles LESS in 2020 than in 2019… I’m not driving here, there and everywhere getting kids to practice or games or meetings and stuff. But we’re home and that also means we don’t need to pay for unlimited internet on the phones because we have wifi in the house- so we’ve cut that to bare bones and are saving a good amount on that.

We used cut my son’s hair and my husbands at home to save money each month. After the incident of the clippers when my son was almost finished third grade, I am no longer allowed to wield scissors near anyone’s hair but the dogs in my family. BUT if you can be trusted and accurate for haircuts, that’s a good way to save some money!

Cutting cable and looking at the various streaming options available may save some money each month. Subscribing to every streaming service in lieu of cable may not, but it’s definitely worth looking into what shows you enjoy watching to see where you can watch them. Buy household products twisely- combine sales with coupons, buy generic when it’s worth it, stock up on items you use frequently. Our laundry detergent was on sale not long ago and I found pretty high value coupons so I bought 6 of them. We’re good to go for a while.

I hope some of these money savings tips for families offer some helpful ideas for you. If you have some other tips, please share in the comments! Also, I’m very aware that as I write this, it’s still 2020, and just this week I noticed the paper goods aisles are empty at stores, so let’s just all do the best we can, covid or not, and be smart about our spending until life is back to more “normal” times.